Employment Allowance

Employment Allowance is a tax relief scheme in the UK that allows eligible small business owners with employees to apply to reduce their annual National Insurance. What is Employment Allowance.

How To Properly Manage Employee Allowance System Online Time Tracking Software Timesheet For Time Expense

For a customer in AmsterdamLeidschendam we are looking for an analytical procurement administrator.

. From 6 April 2020 eligibility rules for claiming the Employment Allowance EA will change. This guidance will help. Employment Allowance allows employers to pay less employee Class 1 National Insurance per payroll with the allowance coming to an.

The Employment Allowance started on 6th April 2014. If youre self-employed you can claim the Employment Allowance if you have employees and your business pays employer Class 1 NICs on your employees earnings. Employment Allowance is a tax relief scheme in the UK that allows eligible small business owners with employees to apply to reduce their annual National Insurance bill.

You need to claim Employment Allowance every tax year. Employment Allowance is a UK Government provision which allows smaller employers and charities to reduce their national insurance contributions NICs by up to 4000 per year. Employment Allowance The Basics The scheme was implemented to help stimulate economic growth and encourage small firms to take on more employees.

The Indian-origin finance minister had promised a Budget which builds a stronger. Rishi Sunak Sets Out UKs Spring Budget Amid High Inflation. What is the Employment Allowance.

It is set against the employers NI that would have been paid up to 4000 a year. In April 2020 the government increased the Employment Allowance from 3000 to 4000 allowing eligible employers to reduce their annual National Insurance contributions NICs bills. Chancellor Rishi Sunak has set out plans to cut National Insurance for retail and to temporarily reduce business rates in this afternoons Spring Statement 23 March.

This measure increases the maximum Employment Allowance from 4000 to 5000 from April 2022. During todays Spring Statement Rishi Sunak flagged the hike in the employment allowance to 5000 for small and medium sized businesses. In this challenging position you become part of the procurement team of our client.

The employment allowance lets employers registered with HMRC claim a reduction in their annual Class 1a national insurance liability paid for the employees when they run payroll. Employment Allowance Rate 20212022 For 20212022 the maximum employment allowance an employer can claim is 4000. As part of a government scheme to help support small businesses those that qualify can apply for Employment Allowance to lower their outgoings.

Employment allowance is a tax relief scheme in the UK that allows eligible small business owners with employees to apply to reduce their annual National Insurance bill by up to 4000. Employment Allowance Employment Allowance allows eligible employers to reduce their annual National Insurance liability by up to the annual allowance amount. You can claim Employment Allowance if youre a business or charity including community amateur sports clubs and your employers Class 1 National Insurance liabilities were.

Partnerships You can claim. Our client is the market leader in collecting and analysing comprehensive Geo-data about the Earth and the structures built upon it. 1 day agoEmployment Allowance is a tax relief scheme in the UK that allows eligible small business owners with employees to apply to reduce their annual National Insurance bill usually.

It is open to all businesses with a total NI bill of 100000 or less during the previous tax year. According to the full Spring Statement report in 2021 SMEs made up 61 per cent of the UKs private sector employment supporting 163m people. What is the HMRC Employment Allowance.

It is set against the employers NI that would have been paid up to 4000 a year. Employment allowance currently allows eligible employers to reduce their annual national insurance liability by up to 4000 a number that will now be increased to 5000. The Employment Allowance which cuts National Insurance NI for small businesses will increase from 4000 to 5000 in April.

Employment allowance currently allows eligible employers to reduce their annual national insurance liability by up to 4000 a number that will now be increased to 5000. Definition of the Employment Allowance The Employment Allowance is a reduction of up to 4000 a year in employers National Insurance NI for certain employers. Apprenticeship Levy Employers and.

You can claim at any time in the tax year but the earlier you claim the sooner you will get. Professional bodies provide updates to. This means eligible businesses and charities will be able to claim a greater reduction on their.

It means they pay less. Employment allowance currently allows eligible employers to reduce their annual national insurance liability by up to 4000 a number that will now be increased to 5000. The Employment Allowance is based on your employer Class 1 NICs liability shown on your Full Payment Summary FPS and normally it is set against your employer Class 1.

The Employment Allowance started on 6th April 2014.

Employment Allowance Is Your Limited Company Eligible To Claim It Contracting

12 Types Of Employee Benefits To Implement At Your Organization

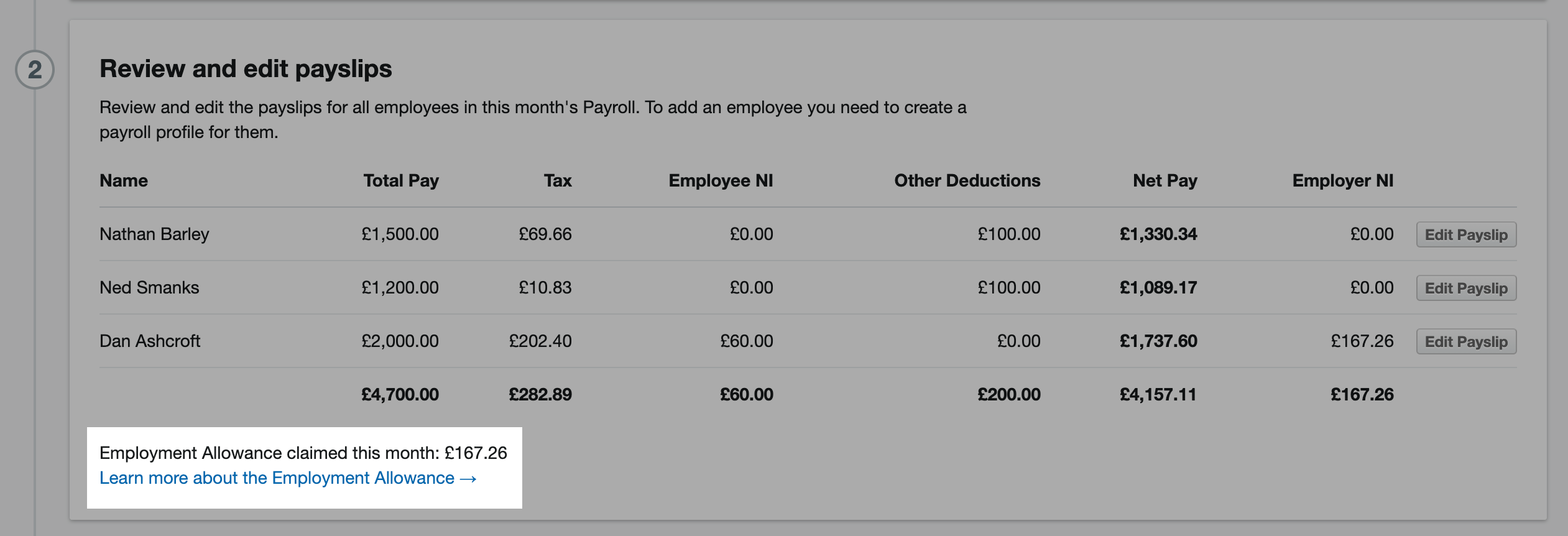

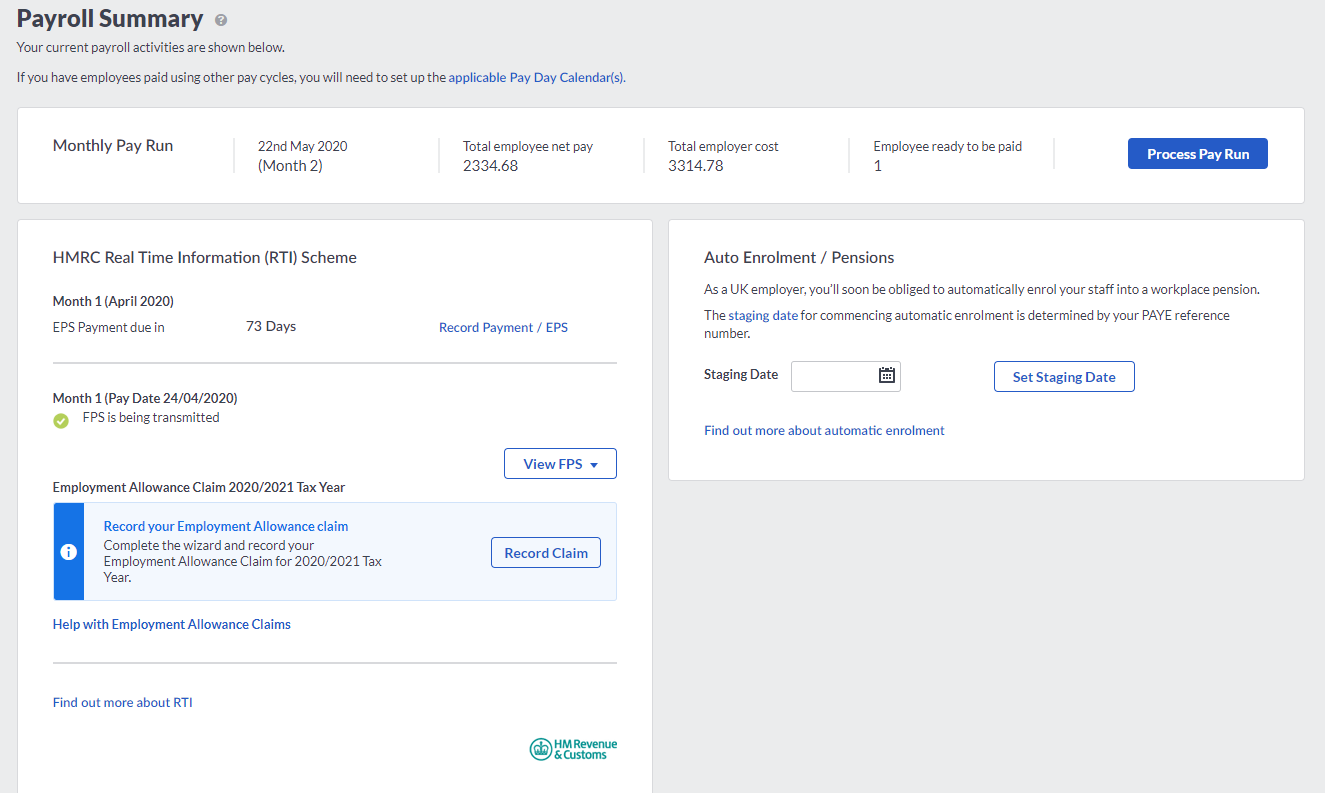

The Employment Allowance Freeagent

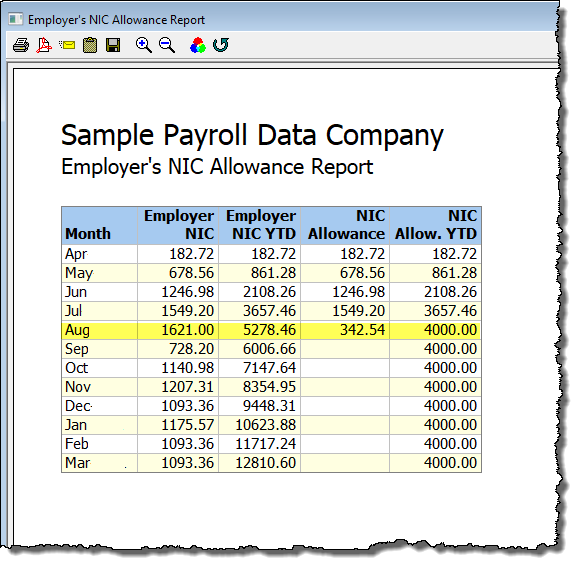

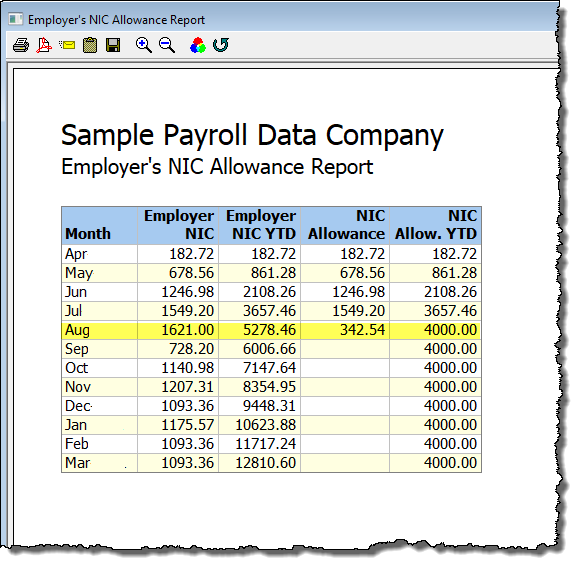

Employment Allowance Moneysoft

![]()

How The Employment Allowance Could Save Your Business 4 000 A Year Freeagent

Hm Treasury On Twitter Increasing The Employment Allowance By A Third To 4 000 A Tax Cut This April For Nearly Half A Million Small Businesses Budget2020 Https T Co Wbctkdm6wx Twitter

Employees Allowance Line Icon Royalty Free Cliparts Vectors And Stock Illustration Image 66904729

Nics Employment Allowance Nics Employment Allowance Flickr

Posting Komentar

Posting Komentar